If you run a mid-market business dealing with foreign currency, there is a good chance your finance team is still managing millions in FX exposure using spreadsheets, manual bank logins, and fragmented processes.

That is the exact pain point London-based fintech Bracket was built to solve. And now, the company has raised $7 million in seed funding to scale its AI-powered treasury intelligence platform internationally.

Who invested in Bracket's $7M seed round?

The round was led by Macquarie Group's Commodities and Global Markets business and Blackfinch Ventures, with participation from existing investor Failup Ventures.

The investment from Macquarie is both financial and strategic. As one of the world's largest financial services groups, Macquarie already licenses Bracket's platform to serve its own mid-market clients, making this a vote of confidence from a customer-turned-investor.

Tom Haigh, Managing Director at Macquarie Group, said: "Macquarie is pleased to back Bracket with both financial and strategic support as it builds an AI-native treasury platform for mid-market businesses. The team has vast experience and have created a highly valuable tool that helps process fragmented financial data with real-time visibility, automation, and control."

Blackfinch Ventures, which backs early-stage UK tech companies across fintech, deeptech, and the energy transition, deployed the investment as part of a wider three-company deal worth £4.5 million. Kimberley Hay, Ventures Director at Blackfinch Ventures, described Bracket as "a standout fintech with a disruptive approach to foreign exchange and treasury," noting the founding team had surpassed forecasts and shown a clear growth trajectory.

What does Bracket actually do?

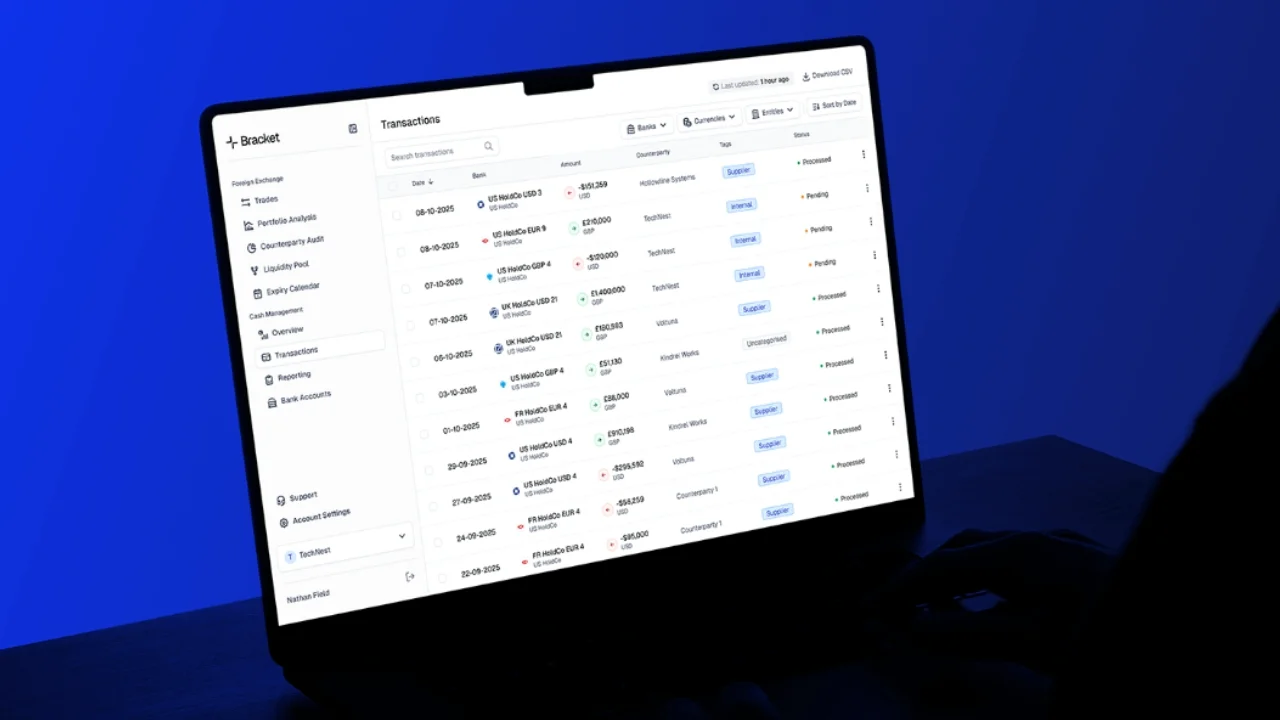

Bracket provides an AI-enabled platform that centralises bank accounts, automates FX workflows, and delivers real-time treasury insights. The goal is to eliminate the manual processes that still dominate how mid-market companies manage their money.

The platform offers centralised multi-bank connectivity with access to over 11,000 banks, automated reconciliation, AI-driven FX automation, exposure management, scenario forecasting, and a no-code setup that finance teams can use without engineering support.

Bracket has also built a bank distribution model. Rather than only selling directly to businesses, the company licenses its technology to global banks and financial institutions, helping them deliver modern treasury tools to their own mid-market customers. This B2B2C approach means Bracket earns revenue from both sides of the equation.

According to the company, it delivered 600% year-on-year revenue growth in 2025 and onboarded both major financial institutions and corporate clients.

The problem: mid-market companies stuck in manual mode

The treasury technology gap is well documented. Large corporates have access to enterprise-grade platforms like Kyriba and GTreasury, but these solutions are typically too expensive and complex for mid-market businesses. The result is that growing companies managing significant FX exposure are left relying on outdated systems.

Pierre Anderson, Co-CEO and Co-founder of Bracket, put it plainly: "Mid-market companies are being held to the same standard as the biggest corporates but they don't have access to the same tools, leaving many to struggle with outdated systems and processes."

He added: "Bracket automates that operational layer using AI to give teams real-time visibility and control over bank data and key information, all within one platform."

Alex Charles, Co-CEO and Co-founder, expanded on why the opportunity exists from both sides: "After decades working across global financial institutions and large corporates, we identified a shared technology gap holding both back. Corporates relied on fragmented, manual treasury processes, while legacy systems were outdated, clunky, and costly to maintain. At the same time, financial institutions lacked the tools to manage FX portfolios and deliver tailored strategies at scale."

The scale of the manual processes can be staggering. According to a FinanceMalta spotlight on Bracket, some of their larger customers were transacting in excess of £5 billion in currency annually while still writing transactions down with pen and paper or manually entering them into Excel.

Who founded Bracket?

Bracket was founded in 2024 by three FX and treasury industry veterans.

Alex Charles (Co-CEO) and Pierre Anderson (Co-CEO) bring a combined 30 years of experience in the deliverable FX marketplace, having previously scaled some of the biggest FX divisions globally. Martin Lee (CTO) has 18 years of experience building high-quality middleware technology for some of the largest hedge funds in the world.

The founders saw the same pattern repeatedly across their careers: companies stuck in manual mode, and banks unable to scale FX solutions for mid-market clients. Bracket was built to fix both sides of the problem.

The company is headquartered in London with a presence in Malta, where it has built a significant client base.

The $7 million investment will fund three priorities: further product development, international expansion with new offices in Europe and Australia, and doubling the team over the next 12 months.

With Macquarie already licensing the platform and a growing base of corporate clients, Bracket is positioned at the intersection of two significant trends: the shift toward AI-powered business tools and the growing demand for modern fintech infrastructure in the mid-market.

For UK founders building B2B fintech products, Bracket's story is a useful case study. The company identified a clear pain point backed by founder domain expertise, built a dual-revenue model that serves both corporates and banks, and secured strategic investment from a customer. That combination of industry credibility and commercial traction is exactly what early-stage investors look for, particularly in today's competitive UK tech funding landscape.

Quick facts: Bracket

Founded: 2024

Headquarters: London, UK

Co-founders: Alex Charles (Co-CEO), Pierre Anderson (Co-CEO), Martin Lee (CTO)

Funding raised: $7 million (Seed)

Lead investors: Macquarie Group, Blackfinch Ventures

Other investors: Failup Ventures

2025 growth: 600% year-on-year revenue growth

Platform: AI-powered FX, treasury, and cash management

Bank integrations: 11,000+

Website:bracket.co.uk

Building a tech startup in the UK? The Tech Founders covers funding rounds, founder stories, and practical guides to help you navigate your journey.

Related guides: