If you are building a hardware-heavy startup, you already know the problem.

Your company needs real, physical assets - energy systems, vehicles, data centre equipment, industrial hardware - long before you hit the kind of scale that traditional lenders want to see.

So you fund everything with equity. You take the dilution. And you hope you can raise again before the runway disappears.

London-based fintech Tangible just raised $4.3 million to change that equation.

What Tangible Does

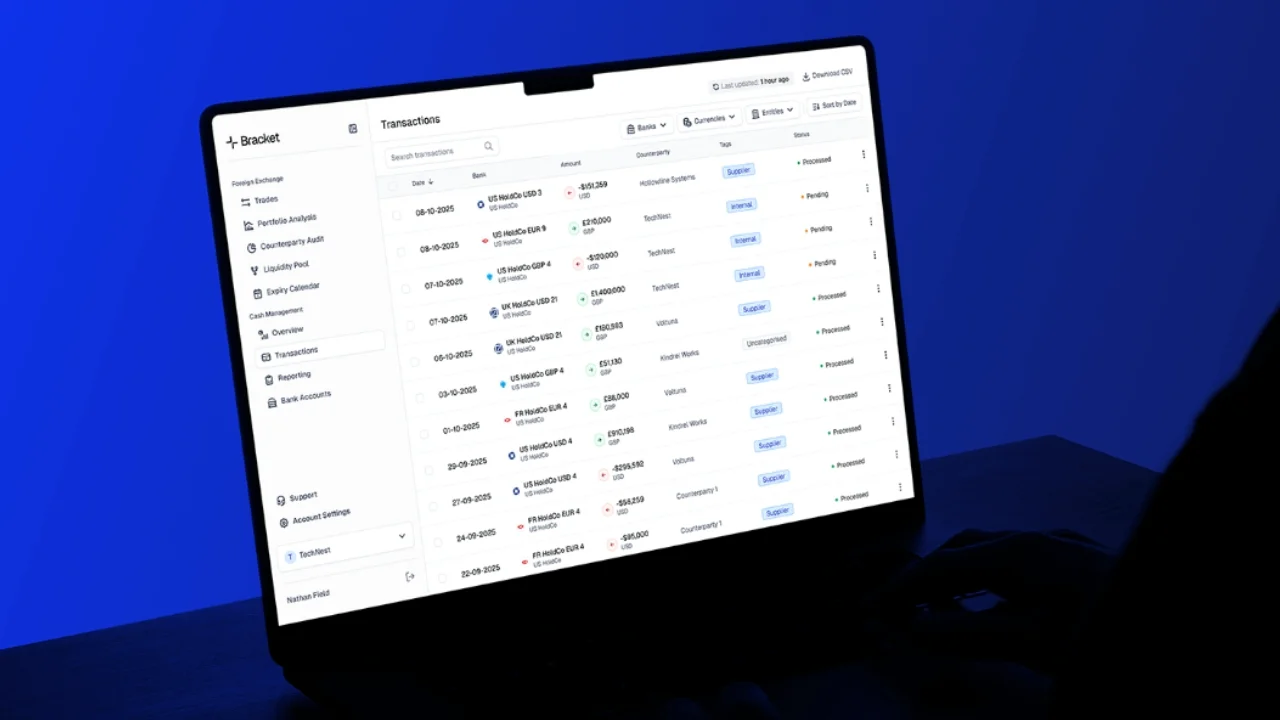

Tangible is building a software platform, backed by structured finance experts, that helps hardtech companies access and manage debt financing.

The core idea is straightforward. Institutional lenders want standardised data, clean documentation, and ongoing reporting before they will underwrite asset-backed debt. Most early-stage hardtech companies cannot provide that without hiring an entire structured finance team. Tangible bridges the gap.

The platform automates the diligence, documentation, and reporting workflows that lenders need. For founders, it opens a path to structured debt without building an internal finance function from scratch. For lenders, it shortens underwriting time and reduces the cost of deploying capital into asset-heavy businesses.

Think of it as the financial infrastructure layer that makes hardtech "bankable" for institutional credit.

The Funding Round

The $4.3 million seed round was led by Pale Blue Dot, a climate-focused VC fund. Participants include MMC, Future Positive Capital, Unruly, SDAC, Prototype Capital, and Aperture.

This follows a £4 million round the company raised in late 2024 when it rebranded from Twist to Tangible. Including grants, the company has now raised a total of approximately $8 million to date.

The funds will be used to expand the team (currently 13 people) and deepen automation across the platform, with a focus on lowering transaction costs and shortening time-to-close for both borrowers and lenders.

Why This Matters for Hardtech Founders

The timing is significant. BlackRock estimates that $68 trillion in new infrastructure investment will be needed by 2040 across energy, transport, compute, and telecommunications. Hardtech companies sit at the centre of this transformation.

Yet the funding playbook for these companies remains broken. Traditional venture capital works well for software startups with low capital expenditure, but hardware-heavy businesses need a different approach. Private credit, now a $3.5 trillion market, is widely seen as the missing piece. The problem is that institutional debt has historically been slow, fragmented, and heavy on bespoke paperwork.

Many founders end up funding their capital expenditure with expensive equity, compounding dilution and, in some cases, threatening company survival. The strongest hardtech companies are the ones that figure out how to use debt as a strategic growth tool alongside equity.

William Godfrey, Co-Founder and CEO of Tangible, put it directly: "Reindustrialisation, energy security, and the race for technological sovereignty in compute are driving unprecedented demand for physical assets. As hardtech companies scale at speed, investors need modern infrastructure to deploy capital just as fast."

Hampus Jakobson, General Partner at Pale Blue Dot, added: "Most of the innovations shaping the future - from vehicles and data centres to robotics - are fundamentally physical. And, to enable efficient innovation, they should not be financed by venture equity alone."

The Founding Team

Tangible was co-founded by William Godfrey (CEO), Aishwarya Dahanukar (CCO), and Sebastian Abdy Sabouné (CPO). Godfrey and Sabouné previously worked together at Founders Factory. The company highlights its diverse leadership, noting one female founder out of three co-founders, two founders from minority backgrounds, and a 40:60 female-to-male team ratio.

The company currently works with a broad range of lenders, from private credit funds and hedge funds to equipment financiers and traditional banks. It has 28 banks on its platform alongside a growing number of private debt providers willing to take on earlier-stage risk.

Where Tangible Fits in the UK Fintech Landscape

The UK's fintech ecosystem continues to produce companies tackling structural problems in financial services. While consumer-facing neobanks and payment platforms grab headlines, B2B infrastructure plays like Tangible address the less visible but equally critical plumbing of the financial system.

For founders building in capital-intensive sectors, the message is clear: structured debt does not have to wait until you are a late-stage company. With the right infrastructure, it can be part of your capital stack from much earlier.

The UK remains one of the world's most attractive destinations for fintech investment, and companies like Tangible are a good example of why. They are not chasing consumer scale. They are building the tools that help other companies scale.

Quick Facts

Company: Tangible

Headquarters: London, UK

Founded: 2021 (originally as Twist)

Co-Founders: William Godfrey (CEO), Aishwarya Dahanukar (CCO), Sebastian Abdy Sabouné (CPO)

Funding: $4.3M seed round (total raised: ~$8M including grants)

Lead Investor: Pale Blue Dot

Other Investors: MMC, Future Positive Capital, Unruly, SDAC, Prototype Capital, Aperture

Team Size: 13 employees

Website:tangible.finance

Building a tech startup in the UK? Join The Tech Founders community for the latest funding news, guides, and resources for early-stage tech founders.

Related guides: